Sanctioned but Sustained: Why the Houthis’ Finances Endure Global Pressure

Group Profile

Since October 2023, the Houthis have intensified their military operations in solidarity with Hamas, launching missile and drone attacks that have destabilized the region and disrupted global shipping in the Red Sea. Their personnel strength has further expanded to encompass approximately 350,000 militants. In response, the US and UK have conducted a series of air strikes, including the March 15, 2025 American bombing of Houthi targets (plans for which were leaked via a Signal group chat).

Since the Houthis continue to pose an economic and security threat, the Trump administration has focused new disruption efforts on the financial networks that sustain their operations. Previous rounds of sanctions and other financial measures have had limited impact due to humanitarian concerns and the Yemeni government's limited capacity to freeze Houthi-controlled assets.

As an addendum to our January 2024 coverage, this article provides additional information on how and why the Houthis have such robust financial capabilities.

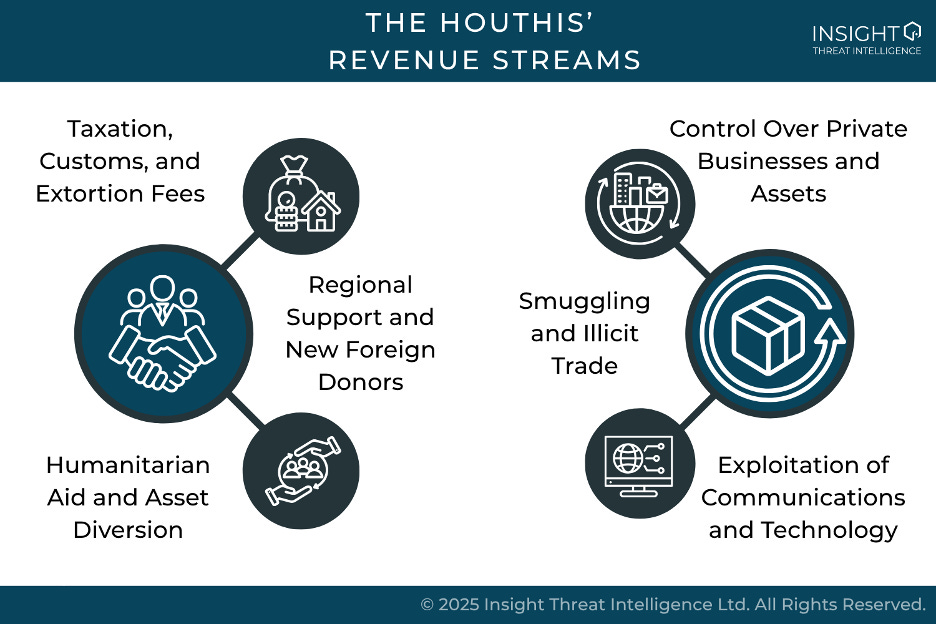

Raising Funds

Taxation, Customs, and Extortion Fees

The UN Panel of Experts on Yemen highlight that the Houthis generate significant revenue, approximately YR 3.392 trillion in 2023 (US 13.6 billion) per year. The group has recently increased taxation, customs duties, and imposed new levies. These include customs fees on goods entering Red Sea ports under their control, which remain critical gateways for goods entering Yemen. The Houthis have also been extorting shipping agencies, allegedly demanding payments in exchange for not targeting vessels. This maritime extortion could generate up to $180 million per month.

On land, the Houthis impose taxes on goods transported from areas controlled by the Government of Yemen into Houthi-held territories. In 2023 alone, revenues from these land-based collection points were estimated at YR 300 billion ($1.2 million).