FINTRAC is Doing the Most: Annual Report 2024-2025

And everyone else is going to have to step up soon (especially the RCMP)

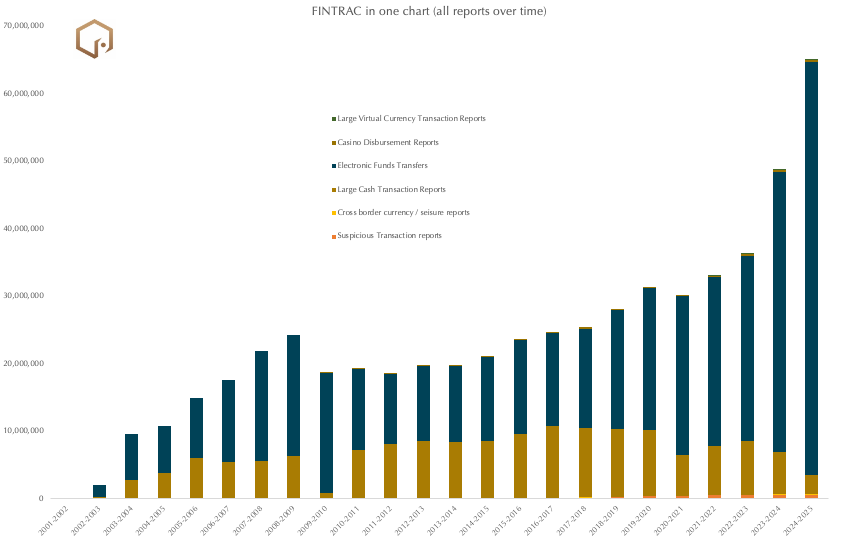

Each year, FINTRAC’s annual report provides one of the only publicly available windows into Canada’s illicit finance landscape. They report on a wide variety of important metrics, including how many disclosures they share with partners, the kinds and number of reports they’ve received, and the number of disclosures provided to law enforcement for criminal non-compliance with Canada’s anti-money laundering and counter-terrorist financing regime. I’ve been conducting independent analyses of these reports since 2022, and I maintain a unique dataset that compiles most FINTRAC-reported metrics back to the Centre’s inception. This enables me to evaluate not only year-over-year changes but also long-term trends in Canada’s counter-illicit finance system. As always, I’ll share charts and visualizations of this year’s data further below.

This year’s report has me asking some serious questions: Canada’s anti-money laundering, counter-terrorist financing, and sanctions-evasion framework gives FINTRAC extraordinary visibility into the financial lives of ordinary Canadians. This is an intrusion into privacy that is justified only if it delivers meaningful security outcomes. Collecting vast amounts of personal financial data may be proportionate to the threats we face, but proportionality depends on the system’s effectiveness, not just its intent. FINTRAC cannot achieve impact on its own; the rest of the regime must convert intelligence into action, enforcement, and results. With the promised Canadian Financial Crimes Agency still on the horizon, we should be asking: is our current AML/CTF and sanctions regime truly effective enough to warrant the level of privacy intrusion it demands?

If there’s one chart I would use to illustrate FINTRAC’s activities over the years, it’s the one above. It outlines all the reports that the Centre has received from reporting entities. However: I’d prefer to contextualize this with the action (or inaction) taken by others in the regime to combat terrorist financing, money laundering, and sanctions evasion. Maybe I’ll do that in the future. But for now, here’s what FINTRAC had to say. This year, there were a few notable shifts — some encouraging, others concerning.

Get caught up on our previous analysis here:

Keep reading with a 7-day free trial

Subscribe to Insight Monitor to keep reading this post and get 7 days of free access to the full post archives.